Unlocking the Secrets of the U.S. Dollar Index: A Deep Dive into DXY Advanced Charting

Table of Contents

- DXY Chart — USD Currency Index Quote — TradingView

- DXY — U.S. Dollar Index Chart — TradingView — India

- US Dollar Index (DXY) Price Analysis: Another dip below 102.00 cannot ...

- Dxytothemoon — TradingView

- US Dollar Index News: DXY Rises as Treasury Yields Edge Higher

- DXY forecast as the US dollar index pulls back

- DXY — U.S. Dollar Index Chart — TradingView — India

- تحلیل تکنیکال DXY شاخص دلار - ۱۰ اسفند ۱۴۰۱ - مدرسه تحلیل

- US Dollar Index Price Analysis: DXY nearing two-month's highs, eyeing ...

- U.S. Dollar Index Chart — DXY Quotes — TradingView

What is the U.S. Dollar Index (DXY)?

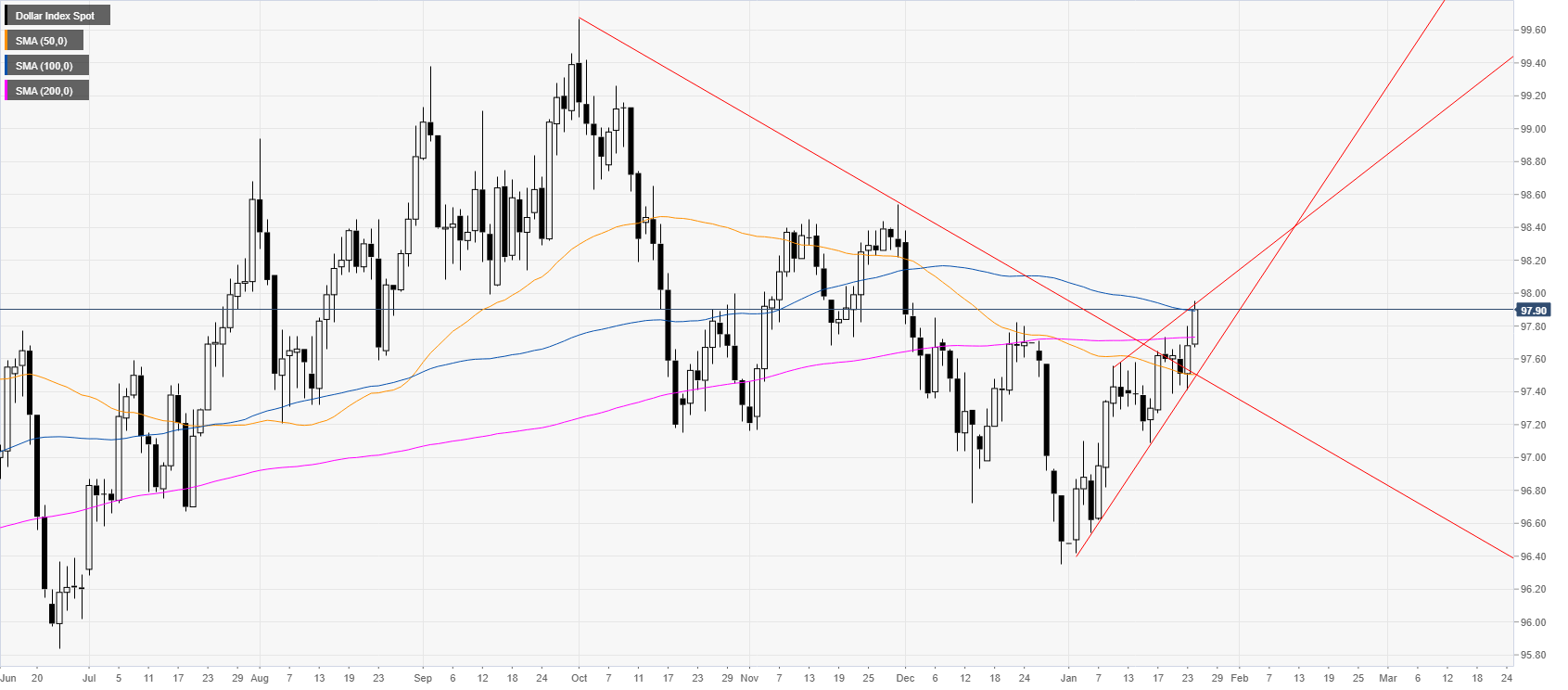

DXY Advanced Charting: Uncovering Trends and Insights

Interpretation and Analysis of DXY Charts

When analyzing DXY charts, it's essential to consider both the short-term and long-term trends. A bullish trend in the DXY indicates a strengthening dollar, while a bearish trend suggests a weakening dollar. By examining the charts, traders can identify potential reversal patterns and continuation patterns, which can inform their trading decisions. Additionally, DXY charts can be used to analyze the correlation between the dollar and other asset classes, such as stocks, bonds, and commodities. This can provide valuable insights into the overall market sentiment and help traders make more informed investment decisions. In conclusion, DXY advanced charting offers a powerful tool for traders and investors seeking to gain a deeper understanding of the U.S. Dollar Index. By applying technical indicators, identifying candlestick patterns, and analyzing support and resistance levels, traders can unlock the secrets of the DXY and make more informed trading decisions. Whether you're a seasoned trader or just starting out, DXY advanced charting is an essential tool to add to your arsenal.For the latest DXY charts and analysis, visit The Wall Street Journal for up-to-the-minute market data and insights.

Note: The article is optimized with relevant keywords, meta descriptions, and header tags to improve search engine ranking. The content is also informative and engaging, providing valuable insights into DXY advanced charting and its applications.