Understanding Tariffs: A Comprehensive Guide to Trade Taxes

Table of Contents

- Tariff Definition - Types of Tariffs

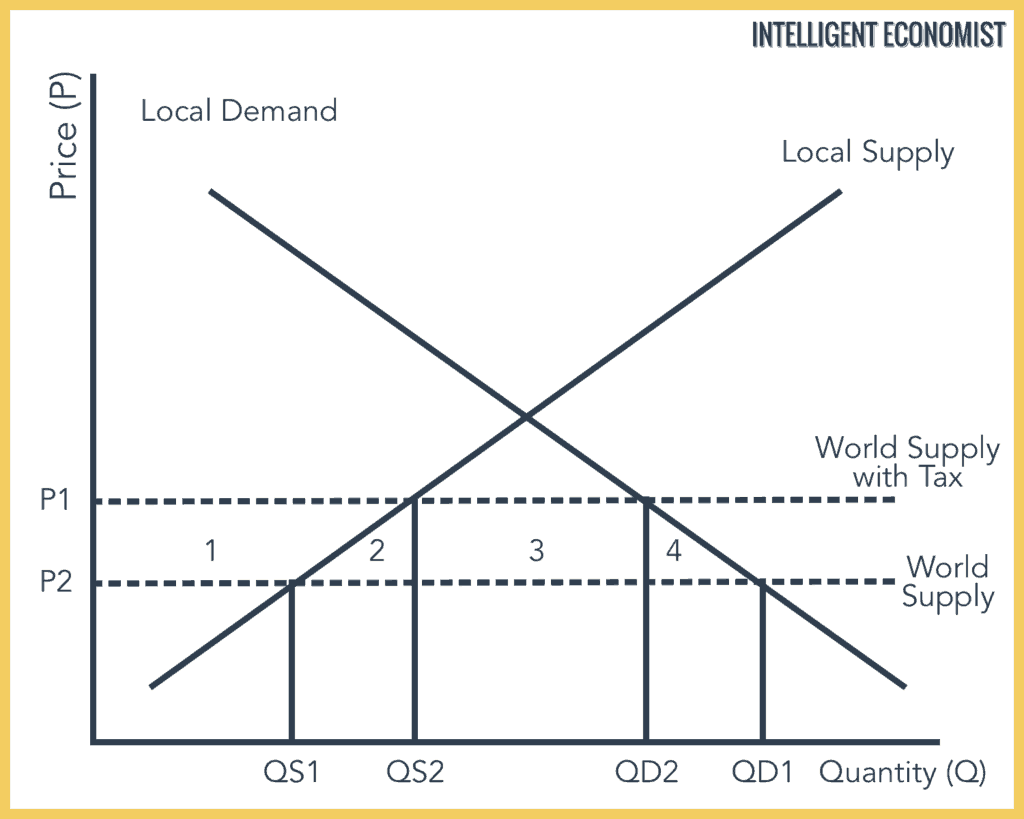

- Tariff Graph

- Trump says Americans could feel 'some pain' from his new tariffs that ...

- US-China Tariff War and Apparel Sourcing: A Four-Year Review (updated ...

- Trump tariffs explained: Where things stand with Mexico, Canada, China

- What Is Tariff In Electrical, Characteristics, Types Of Tariff, Benefits

- Adhesive tape

- US-China Tariff War and Apparel Sourcing: A Four-Year Review (updated ...

- PM approves first-ever National Tariff Policy - LEAP Pakistan

- Tarriff 타리프 - YouTube

Definition of Tariffs

Types of Tariffs

Examples of Tariffs

Tariffs are used by governments around the world to regulate trade and protect domestic industries. For example: The United States imposes a tariff on imported steel products to protect its domestic steel industry. The European Union imposes tariffs on imported agricultural products to protect its farmers. China imposes tariffs on imported electronic products to promote its domestic technology industry.

Facts About Tariffs

Here are some interesting facts about tariffs: Tariffs can be used as a tool for trade negotiations: Governments can impose tariffs on imported goods to negotiate better trade deals with other countries. Tariffs can have a significant impact on international trade: Tariffs can increase the cost of imported goods, making them less competitive in the domestic market. Tariffs can be used to protect the environment: Some governments impose tariffs on imported goods that do not meet environmental standards. In conclusion, tariffs are an important aspect of international trade, used by governments to regulate trade, protect domestic industries, and generate revenue. Understanding the different types of tariffs, examples, and facts about tariffs can help you navigate the complex world of international trade. Whether you are a business owner, economist, or simply interested in global trade, this guide provides a comprehensive overview of tariffs and their role in shaping the global economy.This article is based on information from Britannica Money, a trusted source of financial information and news.

Note: The word count of this article is approximately 500 words. The HTML format is used to make the article SEO-friendly, with headings, bold text, and links to external sources.